what are the basic things to have before meeting the investor

Engagement: 27/10/2020 l Category: Entrepreneurship

At the early stage of a startup, investment decision making happens with fractional information because not plenty data points be. Investors give a disproportionate weightage to the entrepreneur as a person. The driver in the parlance of racing!

I accept heard investors invest based on their liking a person even though the idea morphs into something entirely unlike with time.

The founder(s) is a crucial predictor of startup success. Investors often spend time with the founder to experience how they alive, their controlling, ethics, integrity, resourcefulness, how they focus on problems and respond to challenges, sit-in of their perseverance, and risk-taking power. This requires spending time with an entrepreneur to create a 'flick' of the person. To do this, investors often connect with the founder'due south peers, friends, and erstwhile employers and colleagues, people, and organizations working with the startup (e.g. channel partners, customers, suppliers, traction, and become-to-market, etc.) all potential sources of data.

So, where does this fuzzy analysis fit in?

https://world wide web.forbes.com/sites/chunkamui/2019/01/02/six-words-to-recall-in-2019-call up-big-showtime-small-learn-fast/#6075f6985f17

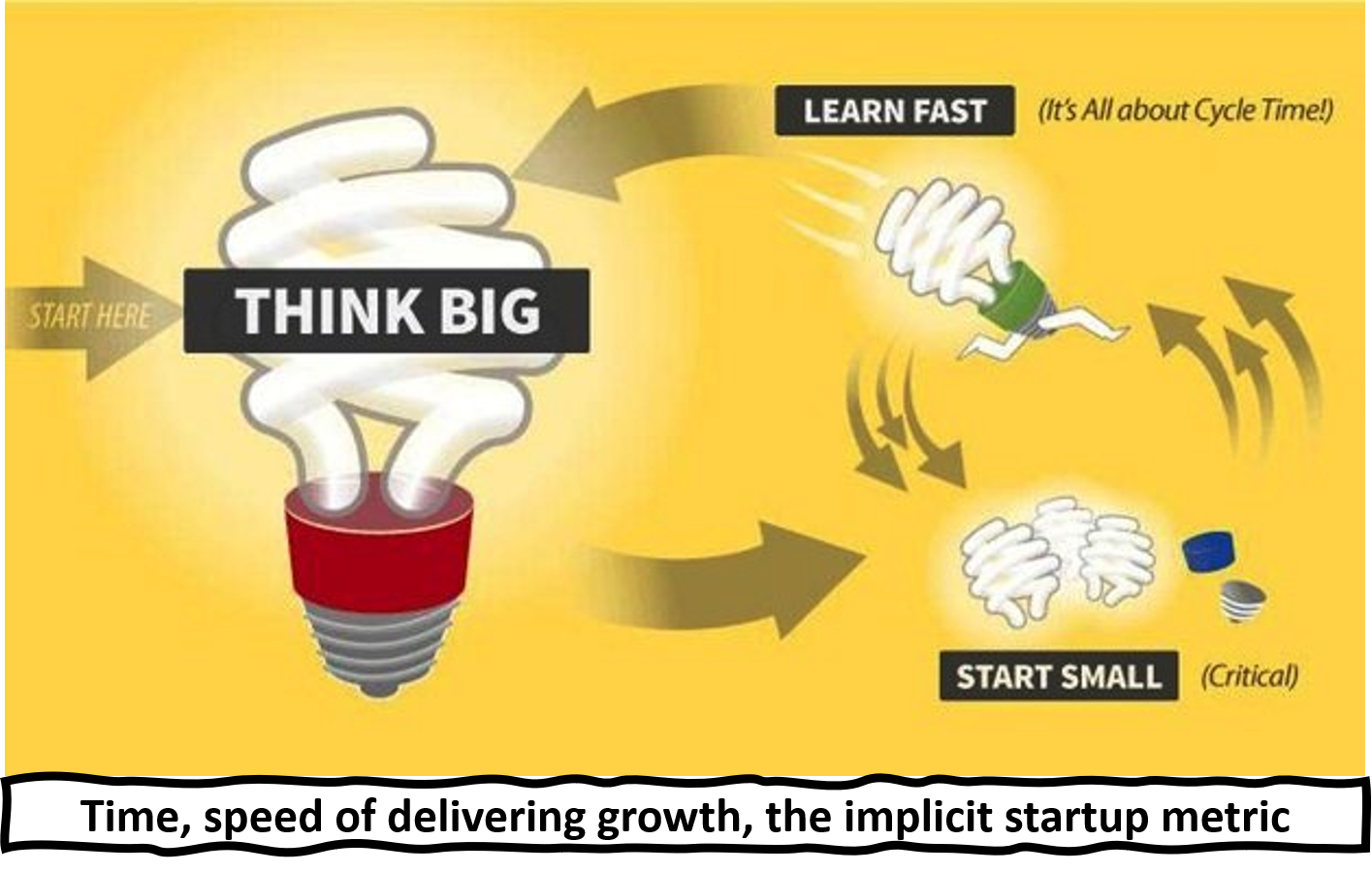

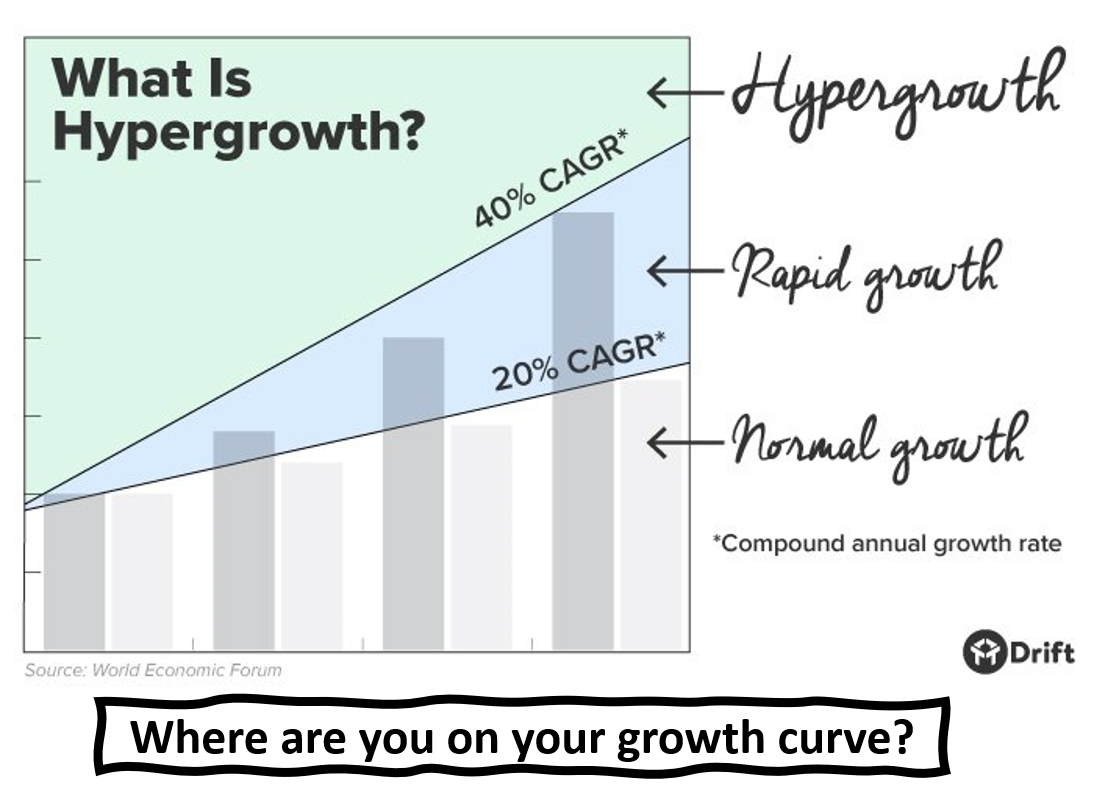

Many of the things that investors await at chronicle to 'time' every bit a crucial unstated metric. In accounting and monthly reporting, 'time' is an implicit variable. Reports just show what happens at a particular moment in time. Investors practice not micro-manage. They want to understand that the entrepreneur's understanding and commitment to the speed of implementation to attain growth with capital is the same as what they want.

Questions that need answering to create a persona.

https://www.slideshare.net/LaurenGilchrist/get-comfortable-shipping-imperfect-products-lean-startup-conference-2014

· Delivery, passion/determination, and integrity

· Adaptability versus perfectionists — Learn to take imperfect products to test with customers. It shows that the founder is set up to (modify direction (pivot) if needed). This impacts the way work gets organized within a visitor. In the early days, responsiveness and turnaround speed during edifice products and developing get to market is critical.

· Coachability — Is the team open up to new ideas and inputs?

https://greerrelief.org/event/renew-service-orientation/2019-10-29/

· Humility and self-awareness — They know what they must acquire to make information technology work

http://world wide web.vitogregolimusic.com/2019/03/02/welcome-to-the-elephant-in-the-room-weblog-chief-phase/

· Completeness of the team — how founders complement/create adequacy needed for what is needed to build the startup. Gaps in team adequacy and how they will exist filled.

· Do they know how to select people, look for skills and personality traits needed?

· How quickly tin can founders learn to atomic number 82 by selecting people and delegating — essential for growth

· Quantum and nature of founder bounty. Fair bounty is acceptable. A sudden increase in compensation raises scarlet flags.

· A founder's willingness to exit

· Specific experience relevant to building the startup — product, marketing/selling, finance, and scaling

· Founders have no choice to know/learn business and finance. They cannot say they practice non know.

· Do they know how to deploy upper-case letter for growth/scale?

https://calebparker.me/entrepreneurship/youre-not-a-scrappy-startup/

Jargon-free questions investors ask and what they desire from entrepreneurs

1. Why are you building this company?

The entrepreneur should exist able to nowadays an elevator pitch describing their why (mission) and their value proposition.

2. Where do you remember you tin can take this business?

The entrepreneur should be able to present a Total Addressable Marketplace, place the focus of the immediate opportunity (target customer segment), their positioning for the customers, and why this choice was made (is it a stepping stone to a larger opportunity).

three. Why do you think customers will desire to buy this more than anything else?

The gap information technology fulfills, solves an important painful problem, and most importantly will become an extremely high growth (viral) opportunity.

4. Why is the timing right for the startup?

Influences of the economic system (tailwind), technology (enablement), or consumer acceptance because of trends.

5. Why does your team have the right to do information technology?

Why should you and your team win? What is exceptional about yous?

vi. Why are others not doing it?

Your knowledge and awareness of the product, technology, and consumer behavior? Explain the unfair advantage you have. Do you have an entry barrier?

7. Does your business/platform get stronger as more people appoint/buy/stick?

Are any network effects possible in the business organisation? How shut is the business to rapid growth?

eight. Why would you practise better than a bigger technology company?

Your execution strategy (monthly with metrics), distribution and sales channels and strategy, and delivery and customer.

9. Why should we invest in the business?

What exercise you need beyond capital from the investor?

10. Value proposition and unmet need.

Clarity with which the entrepreneur defines the value Proffer and unmet need. And a description of the product/service based on the market. Is it already developed, or can they validate it once developed? Take they conspicuously defined their customer? Why is their product/service necessary? Is it doing something different/or doing differently? Is it "need to have"/ "nice to have?" Is it IP based and patenting status?

eleven. How is the offering positioned and market place segmented?

What is space where they will operate? Is it large and growing apace? What is the competition for their product? Strategy to deal with competition. All businesses have contest.

12. How is execution planned?

How will they evangelize results? Their feel with pilots and prototypes, etc. What are their sales/marketing plan? Scaling upwardly program. Risks/mitigation plan. How will they make coin? Who pays them? How do they sell? What channels do they use? At what gross margins?

https://www.crevelingandcreveling.com/weblog/expat-fiscal-planning-curt-term-stepping-stones-aid-achieve-long-term-goals

xiii. Financial plan

Has the founder spent time in planning the month past month cash flows? Current / Projected for the side by side 3 years. When will it intermission even? Personal investment funding is received to date. Investment sought and valuation expectations. Condition of business concern and accomplishments to date (last ~6 months). Timeline (significant milestones over the next ~18 months). How will the money be used? What metrics can they evidence? Employee growth. Client growth. Geography growth.

xiv. Pitch

No lofty statements. Goals with measures. Decode everything virtually the business into numbers.

https://sdssleadership.weebly.com/and-personal-evolution/being-a-persistent-person-is-not-hard

Source: https://exedco.com/blog/how-must-entrepreneurs-prepare-before-meeting-investor

0 Response to "what are the basic things to have before meeting the investor"

Post a Comment